Personal Loans

Transparent, safe and on your terms

A Personal Loan that puts you in control from start to finish: from the calculator to the last installment. No tricks, no fine print.

Applications for products are only available in portuguese.

We are glad you're interested. Please, apply on the Brazilian Portuguese version of our website.

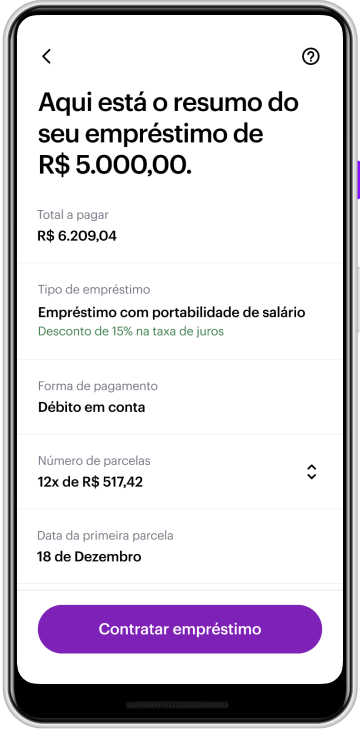

Real-time loan calculator for complete autonomy

Use our calculator to get an overview of your loan. Choose the number of installments and the best date to make your payments.

Before selecting the best option for you, check interest rates, conditions and the total to repay.

All set! Once the loan is approved, the money is instantly transferred to your Nubank account.

Take control of your payments

Choose the number of installments and payment dates

You choose the first payday, which can be up to 90 days after borrowing. And you have up to 24 months to finish paying off the loan. No hidden details.

Auto-debit or bank deposit slip

Pay your installments with automatic debit on your Nubank account or request a bank deposit slip through customer service.

Pay future installments in advance

You can choose to pay as many installments as you want. The interest rates will be recalculated and you will see how much money you saved directly on your phone.

Interest rates designed for you

Fair and tailored interest rates to help you make the best choice for your financial life. Get an overview of your monthly installments, the selected payment period, interest rates and the total amount to be paid in each scenario. In addition to a customer support you can rely on 24/7.

Personal loans with salary portability: lower interest rates and extra flexibility

Rates up to 15% lower for loans

Change your salary account to Nubank and get even lower interest rates when you apply for a personal loan. You can do all the steps directly in the app promptly and with transparency.

Paperless and 100% transparent, the Nubank way of taking out a Personal Loan

Step

To get started, apply for your Nubank account and credit card

Nubank Personal Loan is currently only available to digital account and credit card customers.

If you already are a Nubank customer, go to the home screen on the app to check whether you qualify for a loan.

Applications for products are only available in portuguese.

We are glad you're interested. Please, apply on the Brazilian Portuguese version of our website.

Step

Check if the option "Simular empréstimo" is available on your app

The conditions are designed for you. The amount available may vary each day and you can check it without using the loan calculator.

Step

You can rerun calculations until you find the option that suits you

The calculator is the perfect tool to test the options that work best for you. You can see how much and when you are going to pay for the loan with safety and transparency.

Get the money instantly!

Automatically receive the money into your Nubank account and easily manage your payment plans once the loan is confirmed. All in a simple and efficient way.

Surprisingly simple

Over 2.5 million people have taken on Nubank's loan service and discovered the power of an uncomplicated financial life.

I've heard that payroll is usually for civil servants, or retirees. I never imagined that I would have similar options for someone who is “CLT”. It was the first time. Basically, it is a payroll loan, due to salary portability. — Rodrigo

We can barely believe it was so easy. We’re very happy, because the installments and the interest rates are lower than others we've seen out there. Plus, instead of paying off the loan for countless months, we'll do it in just two years. — Inara

I managed to hitch my business with the loan you offered me in the app along with my brother-in-law, thanks for the opportunity in these difficult days. — Carla

It is very positive mainly because it’s practical, it impressed me. By how fast it is, the bureaucracy is very low. In other experiences I've had with other banks, an amount like that, under these conditions, at this speed, is wonderful. — Marta

Frequently asked questions about Nubank Personal Loan

Interest rates are customized for each customer and can vary according to the month or the number of installments chosen in the simulation. To check the exact rate, just create a simulation.

All employees of private or public companies and also retirees who have a salary account are able to request salary portability. If you receive your salary on a checking account, you will not be able to port it to the Nubank account. To find out if you have access to the loan with salary portability, just see if the option is in your application on Loan panel, by clicking "Simulate loan". If it's not showing, you'll need to wait a little longer.

Yes. The credit portability allows you to transfer your transaction to another financial institution. There are two rules: the total amount of the new loan cannot be greater than the balance you still need to pay. And the new payment term cannot be longer than the current limit either. In other words: to make the portability, the conditions of the other institution must be better than the current one. You need to compare the two proposals well. On Nubank, you can port your loan to another financial institution at any time. To do that, you just need to contact the institution you want to transfer to.